Contents

London is considered the largest global financial hub and as a result, the London session open is marked on every bank and retail Forex trader’s daily calendar as a time of increased volatility. Below is a table of the New York Trading session pip ranges of the major currency pairs. Below is a table of the London session pip ranges of the major currency pairs. Below is a table of the Asian Trading session pip ranges of the major currency pairs.

However, given the significant increase in trading volume at this time, it makes breakout trading much more lucrative. Hedge funds with international exposure often buy and sell a large number of stocks across the globe to diversify their portfolios. To buy something you need someone else to sell you want you are trying to buy and vice versa. So, if you are trying to buy USD/JPY in the middle of the night when nobody in the United States or Japan are awake, then there is a good chance that you will have a hard time doing business. This is why in practice; you should spend your active trading hours when there are ample buyers and sellers in the market. Session times also vary according to daylight savings times in the relative regions – so the Sydney, London and New York forex session times are impacted by daylight savings, whereas Tokyo is not.

Forex market hours in India

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Spot Gold and Silver contracts are not subject to regulation under the U.S. Before deciding https://1investing.in/ to trade forex and commodity futures, you should carefully consider your financial objectives, level of experience and risk appetite. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters.

Traders often focus on one of the three trading periods, rather than attempt to trade the markets 24 hours per day. This is one of the more destructive habits of new traders and is enabled by the fact that the Forex market never closes. Also, you may have already noticed that some Operating Income vs. Net Income overlap quite significantly. You can use this to your advantage knowing that pairs like AUDJPY and NZDJPY will have the highest volatility during the Forex Market Hours of these two sessions. So although the ability for retail traders to participate is halted over the weekends, the Forex market as a currency exchange is alive and well. News related to those of the United States, can dramatically change the course of the dollar.

Best Forex Brokers for beginners in Tanzania 2022

The forex trading sessions are named after major financial centers and are loosely based on the local “work day” of traders working in those cities. Due to its strategic location, the city of London has always been at the heart of trade and commerce all over the world and especially in Europe. Though there exist several financial centers across the whole of Europe, London is the place where investors and traders alike keep their eyes fixated. The city’s morning overlaps with the late trading of the Tokyo/Asian session while its evening overlaps with that of the beginning of the New York or American session. This is what has made London the foreign exchange capital of the world with about 43% of all forex transactions taking place in this session. You can trade almost every one of the G10 currency pairs when New York is open for business.

Usually, traders have quite the challenge after the market opens to start the week, and as the prices switch back and forth throughout the day, traders need to be aware during this time. Knowing the forex market’s operating hours is essential for a trader. You need to know when the forex market opens and closes as well as the four main trading sessions.

Renko Candles Overlay Indicator for MT4

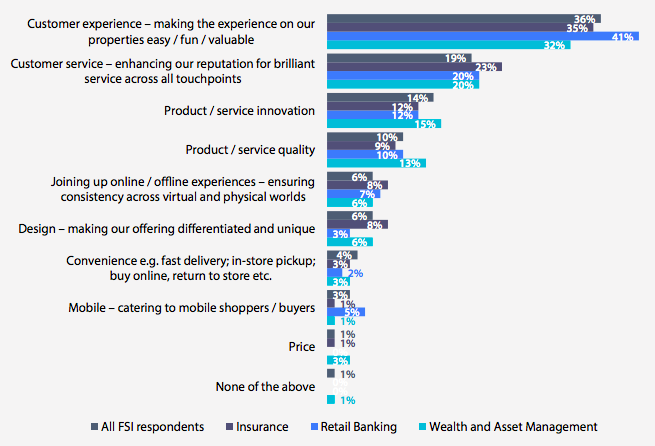

Use the below Forex Market Clock to check where your current time is in relation to the 4 major forex trading sessions . Now let’s take a look at the average pip movement of the major currency pairs during each forex trading session. This article will focus on the first two – the best forex trading hours for your geographical location, and the peak times of each week based on various time zones. The forex market is the largest and most liquid market in the world.

Let’s take a look at three major Forex market hour-based strategies you can apply today to improve your win rate and increase profitability. Let’s take a more in-depth look at each of the sessions, as well as those periods when the sessions overlap. Even though trading starts in New Zealand, it’s still called the Sydney session. Some traders prefer to differentiate sessions by names of the continent, other traders prefer to use the names of the cities.

- Additionally, traders may get impatient waiting until Sunday as the Sydney market opens, and even harder to keep track of when the trades close on Friday when the week’s span ends.

- Naturally, there is high liquidity in the first half of the session, while the european markets are still open.

- This is what has made London the foreign exchange capital of the world with about 43% of all forex transactions taking place in this session.

- The best time to trade is when the market is active with lots of forex traders opening and closing positions, which creates a large volume of trades.

- That’s Sunday evening at 17h00 EST in New York and close to midnight on Sunday evening in London at 10h00 BST.

Please note that market liquidity is very low at the start of the trading week. Therefore, many traders consider the market to be open only for the 5 weekdays. In addition, on Fridays, there is a high probability that the markets will reverse their direction, as us traders close their positions to stay away from news events over the weekend. Thus, whenever news comes from China, it tends to increase market volatility. Moreover, since Australia and Japan rely on Chinese demand, we can expect a significant movement in pairs with AUD and JPY.

Forex market trading is related to open and close sessions in NY, Sydney, Asia, and Europe. You now understand the various sessions and why trading through high liquidity is significant. In addition, we can now understand the Forex market clock, including the opening and closing hours throughout the week.

Best ECN forex brokers in 2022

Well, the market is really open 24 hours, but this does not mean that you can trade at any time. And if the market is not active, you will not be able to make money, because there will be no significant movements in the market. However, we will not consider the trading sessions of all countries.

Since the Tokyo or Asian session is a very muted one compared to the other two sessions, it presents a trader with the opportunity to trade and manage the risk better. The slow nature of the foreign exchange market in this session allows a trader to accurately quantify the risk and reward. In general, it is a bit easier for traders to spot the levels of support and resistance as they are usually well-defined in this session and often coincide with the trading range.

The London session opens at 0800hrs GMT, just as the Tokyo session closes. This is the biggest forex trading session, accounting for over 32% of all activity. London is a major global financial hub and is used as the reference for all major European financial centres. The London session is characterized by massive liquidity and high volatility. Many currency pairs make their biggest price moves during the London session. The high liquidity also means that most currency pairs are traded with relatively thin spreads.

For beginners, high liquidity with enough volatility to make gains but not burn yourself is ideal. Most forex traders – particularly beginner traders – prefer a smooth, liquid market because it’s easier to manage risks. They don’t find themselves bearing the brunt of drastic price moves that periodically occur in illiquid markets. To Forex traders, this gives a lot of advantages which are not available in the other financial markets. So, no matter where the traders are in the world, they can trade Forex by taking advantage of many things such as global trade opportunities and session overlaps. In this article, we will explore each of these forex market sessions including their key characteristics – forex time zones and how they affect trading.

References to Forex.com or GAIN Capital refer to GAIN Capital Holdings Inc. and its subsidiaries. With Forex.com, you can trade forex 24-hours a day, five days a week – from 10pm on a Sunday evening to 10pm on a Friday night. You’ll have the choice of trading 90 global FX pairs with competitive spreads. Tokyo is the first forex session to open, and many large participants use the trade momentum In Asia to develop their strategies and utilise as a gauge for future market dynamics.

But like most things, it’s all relative to your trading style as well as your lifestyle. There are various sessions that occur around the world which make up the Forex hours each day. London is a key financial center, so there is the highest volatility during this session. Trading forex on margin carries a high level of risk and may not be suitable for all investors. Our aim is to make our content provide you with a positive ROI from the get-go, without handing over any money for another overpriced course ever again.

Forex Market Hours Based Strategy No# 3: Intraday Trading During Second Half of London Session

These three peek sessions are called European, North American, and Asian trading sessions, based on the names of continents. The best time to trade Forex is when there is either movement upward or downward. But when the market is still and not moving at all, there is very little chance for you to make money. It’s also important to be aware that high trading activity also leads to high volatility. While some traders like the opportunities that volatility can bring, others do not – either way, it’s vital to have a risk management strategy in place.

If we talk about statistics, since the Japanese yen is the third most traded currency, it accounts for 16.5% of all operations on the Forex market. If you have a strategy that relies on volatility or high liquidity, make sure you’re trading during New York and Europe’s peak hours. During this time there is a lot of overlap with London, thus making this the best time to trade for a couple of reasons we’ll get into later.